The business world is becoming increasingly complex and uncertain. Globalization, digital transformation, and ever-changing market conditions require companies to be more agile and proactive. At this point, managing business risks is critical to the long-term success of any organization. Artificial Intelligence (AI) and Business Intelligence (BI) are two transformative technologies revolutionizing risk management. These tools not only give businesses the ability to detect risks in advance but also optimize strategic decision-making processes.

In this article, we will explore how AI and BI can be used to manage business risks more effectively and examine the advantages these technologies offer to businesses.

Business Risks and the Need for Management

Every business, regardless of size, faces operational, financial, strategic, and regulatory risks. Risk management is the process of identifying, analyzing, and minimizing these risks. Traditional risk management methods often rely on manual data collection and analysis, which can be time-consuming and prone to human error.

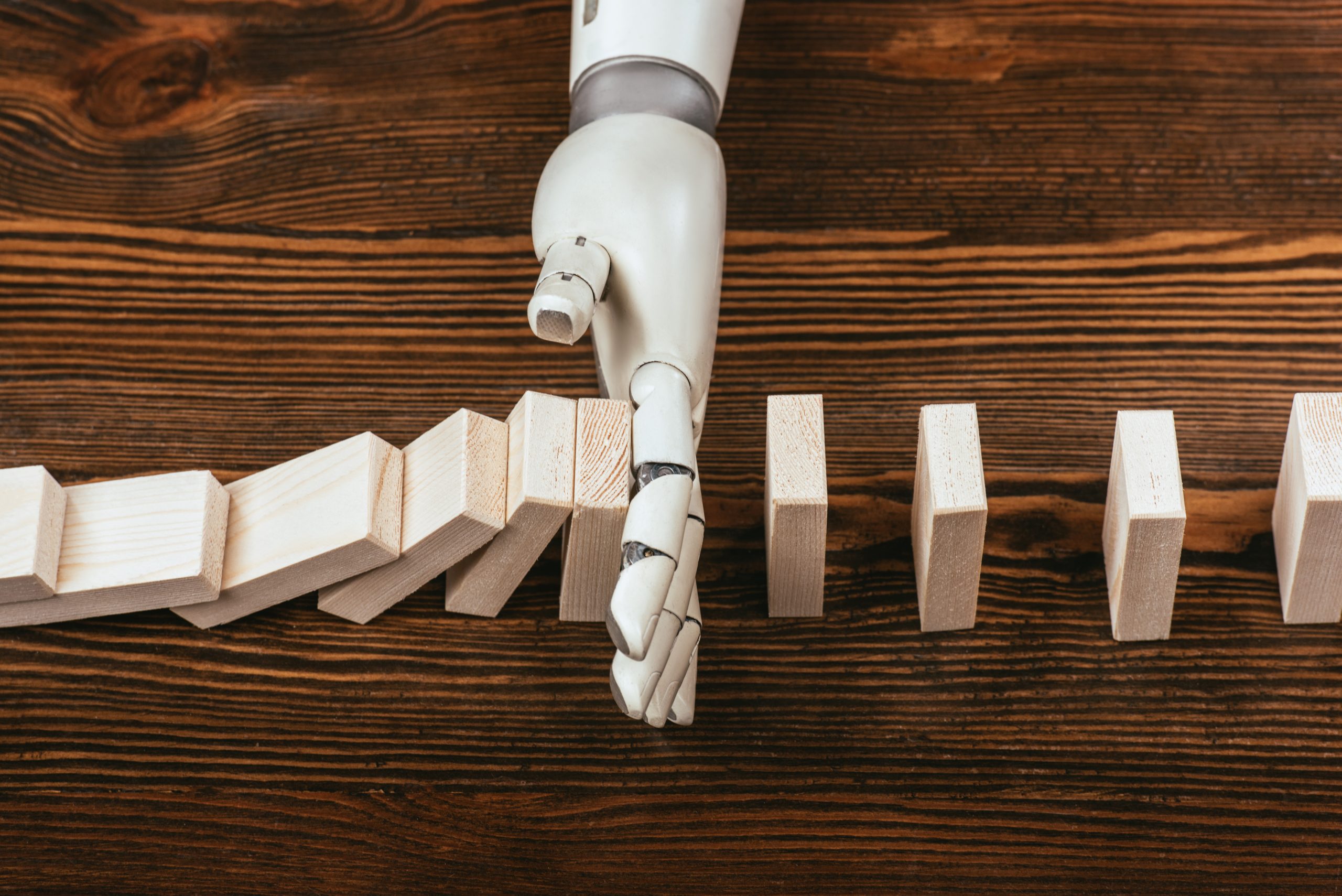

AI and BI automate this process, providing faster and more effective risk management. Big data analytics, machine learning capabilities, and access to real-time information enable businesses to manage risks more proactively.

Risk Management with Artificial Intelligence

AI holds great potential in the business world for managing risks. AI is particularly powerful in analyzing large datasets, predicting potential future risks, and creating automated warning systems. Many of the risks businesses face can be detected before they arise, allowing for preventive measures to be taken.

-

Predictive Analytics

One of AI’s most valuable features is its ability to perform predictive analytics. By analyzing past data, AI can forecast future risks. For example, a company using AI could detect potential disruptions in its supply chain or predict a drop in sales based on customer behavior.

These insights allow businesses to identify potential problems early and take preventive measures to minimize financial losses.

-

Automated Warning Systems

AI can automatically send alerts to businesses when certain risk factors arise. These warning systems detect data anomalies and immediately inform organizations of potential threats. For instance, in the banking sector, suspicious transactions can be detected to minimize fraud risk.

Such alerts allow for quick action without human intervention, helping manage risks more effectively.

-

Legal and Regulatory Compliance

AI also plays an important role in ensuring businesses comply with legal and regulatory requirements. In sectors subject to complex regulations (e.g., finance and healthcare), AI can quickly adapt to changes in laws and develop automated compliance processes based on these changes.

Risk Management with Business Intelligence

Business intelligence supports data-driven decision-making processes. BI tools collect data and provide meaningful reports and insights. In terms of risk management, BI tools help managers better understand risks and make strategic decisions.

-

Real-Time Data Analysis

BI tools provide businesses with real-time data, allowing them to detect sudden risks. This enables businesses to respond to potential risks in a timely manner rather than ignoring them. For example, real-time data is at the core of risk management in financial markets. With this data, businesses can quickly react to market fluctuations.

-

Risk Reporting

BI tools are among the most commonly used solutions in risk management. Risk reports visualize a company’s current risks and provide decision-makers with a strategic perspective. For example, understanding which products or services carry higher risks makes it easier to take the necessary steps to mitigate them.

-

Scenario Analysis

BI tools allow the analysis of various scenarios. By examining different strategies and decisions, the risks associated with each can be identified, and the best solution can be determined. For instance, BI tools can help companies determine how they would respond under different market conditions, offering flexibility and preparedness.

Proactive Risk Management with AI and BI

AI and BI offer significant advantages for businesses in terms of risk management. These technologies enable companies to adopt a more proactive approach by not only managing existing risks but also future risks.

- Faster Decision-Making: Real-time analysis allows businesses to detect risks instantly and respond quickly.

- Accurate Predictions: AI and BI analyze data to provide more accurate predictions, minimizing human error.

- Cost Savings: Costly risks are detected early, allowing businesses to take preventive measures and reduce financial losses.

AI and BI make risk management processes more efficient, proactive, and strategic. These technologies help businesses identify not only current risks but also forecast future risks, enabling a more proactive approach. AI and BI increase decision-making speed, provide more accurate and precise analyses, and help prevent financial losses. As the use of these technologies becomes more widespread in the future, businesses will be much better equipped to handle risks.